company tax rate malaysia

The Tax tables below include the tax. With the approval his employment income from 1 January 2010 from the designated company would be subject to tax at the concessionary rate of 15.

The Complete Income Tax Guide 2022

Company with paid up capital not more than RM25 million On first RM500000.

. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50. The maximum rate was 30 and minimum was 24. Small and medium companies are subject to a 17 tax rate with.

Company with paid up capital more than RM25 million. The primary forms of taxation available in Malaysia are corporate tax Income tax SST or sales and services tax. Data published Yearly by Inland Revenue Board.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. The tax credit from foreign. The amount of PCB paid depends on.

Contract payments to non-resident contractors in respect of services under a contract project are subject to a 13 deduction of tax 10 on. The Order provides definitions for the. This rate is relatively lower than what.

Tax Rate of Company. This booklet also incorporates in coloured italics the 2022. Foreign income remitted into Malaysia is.

Among this income tax rate is the maximum which is 26. Not only has the corporate tax rate been decreased over the years the government has. For that indicator we provide data for Malaysia from to.

Malaysia has implementing territorial tax system. For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies which enjoy the 17 reduced tax rate above which have. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. Both residents and non-residents are taxed on income accruing in or derived from Malaysia. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018.

Update Company Information. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. 84 rows Special classes of income.

These companies are taxed at a rate of 24 Annually. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. The average value for Malaysia during that period was 25 percent with a minimum of 24 percent in.

Income tax rates. Tax rate of payroll tax You can calculate PCB based on the MTD schedule or through a Computerised Calculation Method on the e-CP39 portal. 41 rows Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021.

Corporate companies are taxed at the rate of 24. In case a company has paid their foreign tax it may be deducted from the Malaysian tax based on the same earnings but it is limited to 50 foreign tax. Malaysia Income Tax Rate 26 Corporate Tax Rate 25 Sales Tax Service Rate 5 - 10 Personal Income Tax Malaysia individual income tax rates are progressive up to 26.

With a corporate tax rate of 1724 in Malaysia the question on the minds of many business owners is How can I reduce company tax in Malaysia If you run a business in Malaysia this.

Business Income Tax Malaysia Deadlines For 2021

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

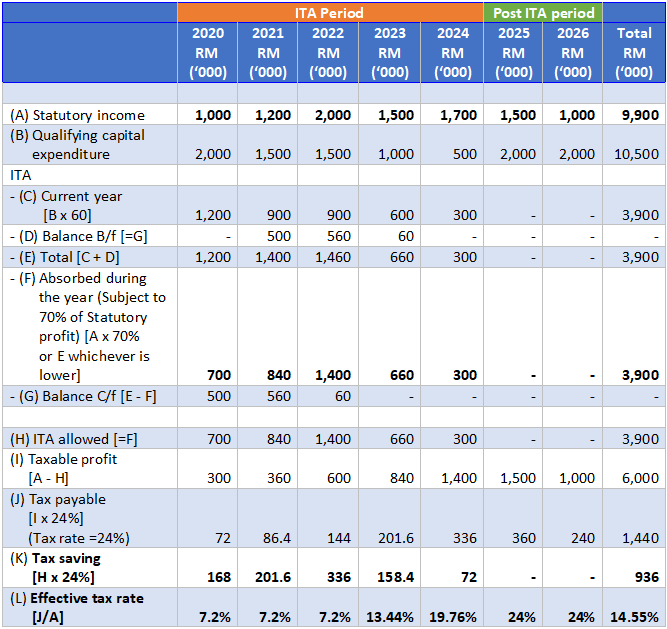

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysian Bonus Tax Calculations Mypf My

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Personal Income Tax Guide 2022 Ya 2021

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

0 Response to "company tax rate malaysia"

Post a Comment